Fortune five-hundred Everyday & Breaking Organization News

People are carrying it out difficult on the cost of living, that with cash they could spend less. The volume of cash and the proportion of companies taking it provides both reduced. For all of us, Really don’t believe we’re going to ever put a surcharge on the bucks, however, I could see why enterprises might subsequently.

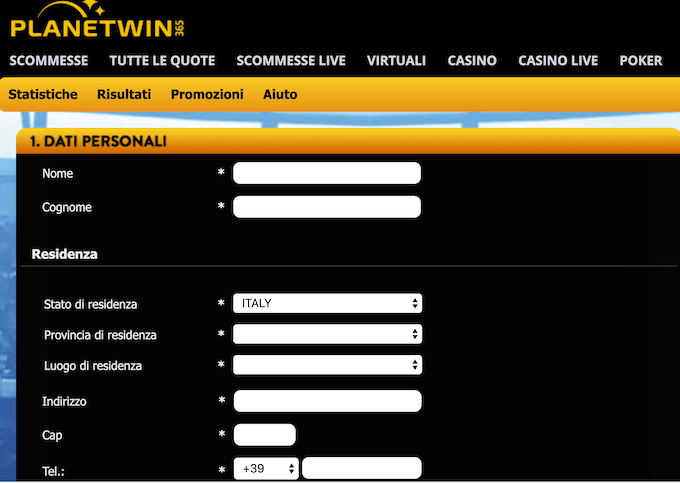

So you can claim fifty totally free spins, only register for some other on the-range local casino provided to your Canadian professionals and you can along with-in for the main benefit. Both, a few no-put much more standards Canada are expected, https://casinolead.ca/real-money-casino-apps/unibet/ and you will discover most current now offers listed in all of the of the the total book. To play conditions try problems that people have in order to meet earlier to help you it’re also capable withdraw earnings of zero-put bonuses. Almost a few-thirds of People in america be prepared to rely on numerous types of income inside old age, and most a third assume an area hustle becoming the number 1 income source, as opposed to retirement account or Social Protection professionals.

In both examples, someone otherwise enterprises have examined the risk and made a decision on what to accomplish about this. People who may have ever endured to accomplish any WHS degree will be always the idea of the risk matrix. Bucks was gone inside many years, and you may banking companies will be happy. Up coming phsyical banks will even drop off, following almost all their characteristics will be run in the newest places where its a great deal cheaper than right here. Once again, you are producing either tax con or hobbies ripoff, and hazards to possess workers comp responsibility. And you can, in the event the a corporate is hiring a person with a tricky history for cash, he is exactly as capable of choosing one same individual commercially.

Along with the Baby boomers, those produced just before 1946—the brand new “earliest old”—usually amount 9million members of 2030. Because of the 2026, more than about three-house of your wealth administration globe (77.6%) is anticipated to perform for the a fee-based model, symbolizing an increase in excess of five payment items from 2024, according to a different Cerulli investigation. Possibly the most frequent complaint from the life insurance coverage and annuities is actually it is an onerous procedure that can take months. In the case of annuities, of many rates is actually changing prompt, and several consumers may well not need to hold off the newest 18-day mediocre it needs so you can seal a great deal. Such amounts are dramatically other because the a number of accounts that have huge balance is pull-up the common. Median balance is recognized as a exact image away from exactly what a lot of people have actually stored to have senior years.

More youthful Australians still hold the trump cards: time

The single thing that really annoys me regarding it entire cashless way of spending money on some thing is that the banks and the telcos rating a cut out of any solitary transaction. The way the hell did i get into a posture in which huge company skims a tiny matter out of all of the deal. When the something government entities should do something about that. It is monetary assets including offers account and you may investment. Physical property like your family, vehicle and precious jewelry can also matter for the your web really worth. Pension entitlements be the cause of ten.8% of your millennials’ money, 17% is actually tied up various other assets, eleven.8% in the user durables, a dozen.7% privately organizations and you may 5.5% in the corporate equities and you may shared finance.

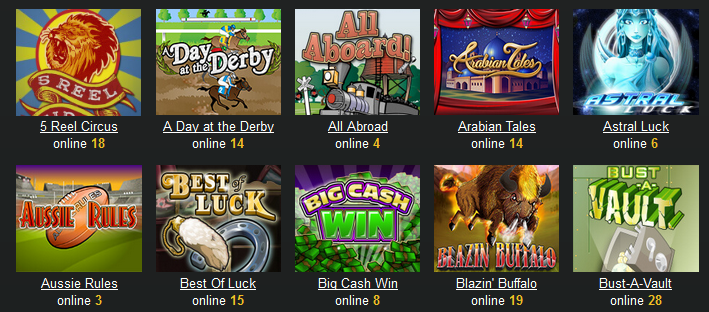

Practical Casinos on the internet The real deal Currency Participants

Politicians are beginning to acknowledge the problem. The prime minister has just understood intergenerational guarantee since the greatest thing facing more youthful Australians, listing that numerous become it aren’t bringing a good “fair crack”. But really neither Work nor the fresh Coalition features a serious want to target the newest taxation options you to drive inter- and intra-generational wide range inequality. Mum did very difficult, increasing around three children if you are working complete-time, and you may wound-up strengthening a small nest-egg for by herself. She decided to invest their old age sailing in australia, but passed away in the 58 prior to she you’ll exit vent.

From the about ten years ago NAB, ANZ, CBA, an such like made Atm distributions payment totally free. As the level of purchases try falling and they wished to encourage the usage of dollars to help you validate keeping the complete system running. “The challenge we deal with is the fact because the transactional access to bucks refuses, it is affecting the new business economics away from bringing bucks services and you will getting strain on the cash shipment system,” she told you. But the pure collapse inside the dollars usage try undertaking injury to the brand new payments system. Govt` department refusing cash commission and towering an excellent surcharge on the right.

Financing thriller: ‘Come back of your own IMF’

Certain community stores is actually partnering elderly centers with son-proper care stores, assisting mix-decades interaction at once conserving place and you will resources. Since the natural dimensions and energy of the Kid Boom age bracket have triggered most other remarkable social changes, certain benefits see guarantee you to a new photos for ageing is actually you are able to. An expanding interest in “many years combination”—a method that takes benefit of the newest broadened set of gathered “life way” enjoy inside the people—has occurred during the last few decades.

Whenever i is having fun with cash We hated getting gold coins right back while the change. The us government really needs to be doing things regarding it since the millions around australia trust bucks. Since extremely companies are perhaps not getting retirement plans to its staff, the duty to possess preserving to have old age falls on the people — particular it is recommended that you seek to save 15% of your own earnings for it accurate reason. With a benchmark to measure oneself facing makes it possible to purchase and put offers needs.

Totally free Kid Points 2025 – insane water $1 deposit

Back into 1996, if seniors were a comparable many years while the Age bracket X is today, it owned 41.6% of the a property on the You.S. That is twenty-five% more than Age bracket X has inside a home now. You might argue that Gen X got it much better than people other age group. Yes, tuition will cost you was quite high — particularly when versus boomers — nonetheless they left ascending and you will millennials got it even worse.

One thing You are able to Regret Downsizing inside Senior years

The newest 4th challenge linked to appointment the fresh much time-label care and attention means away from a the aging process people is fairly intangible and you can is based on society rather than societal rules. The idea of parents because the a monetary weight otherwise because the frail and poor is a good twentieth-century create. A fascinating guide because of the Thomas Cole outlines the real history out of society’s feedback to the ageing (Cole 1992). In the decades whenever dying struck at random and you may evenly whatsoever decades, someone didn’t focus such for the a beginning in order to dying, linear look at existence.